one. Trade the News: GENIUS Act Stablecoin Strategy

Thought: Trade copyright-associated shares (like copyright, Circle, or copyright) Anytime stablecoin regulation news drops.

Why it really works: Regulatory clarity = more trust = price Strengthen.

Tip: Look ahead to official Monthly bill updates from U.S. Congress just before leaping in.

two. Substantial-Volatility Periods: Gold vs USD Throughout CPI News

Plan: Every month, once the U.S. inflation report (CPI) drops, gold and USD shift tricky.

Method:

If CPI is significant → gold pumps, USD drops

If CPI is reduced → USD pumps, gold falls

Tip: Enter trades following the candle spike (not all through), and use modest lot dimensions.

3. copyright Hack Reversal Trades

Thought: After a massive hack (just like the $100M Nobitex one particular), big cash drop tricky, but normally bounce in 24–48 several hours.

Strategy:

Enable stress promoting finish

Acquire strong assistance ranges

Purpose for fast Restoration trades

4. Trump vs Biden Election = VIX and Greenback Performs

Idea: As U.S. elections warmth up, volatility spikes. Trade the VIX Index (volatility), USD pairs, and protection sector shares.

Setup:

If Trump prospects → USD strength

If Biden sales opportunities → stimulus rumors = hazard-on

five. Scalping Meme Cash on News Times

Strategy: Cash like DOGE and SHIB go wild on buzz days (Elon tweets, new listings).

Technique:

one-minute or five-moment scalps

Smaller entries, fast exits

Prevent-decline is a must

Warning: Don’t maintain these lengthy-time period Unless of course you like emotional rollercoasters ????

6. Oil Rates vs Center East Conflict

Notion: Tensions trading ideas in Iran, Israel, or OPEC international locations result in crude oil spikes.

Trade Crude Oil (WTI/Brent)

Purchase throughout conflict escalation

Provide immediately after peace talks or Formal statements

Reward: CAD/JPY also reacts to oil news.

seven. Tech Earnings Time = NASDAQ Breakouts

Plan: In the course of earnings time, trade NASDAQ shares like Apple, Amazon, or Microsoft.

Method:

Invest in ahead of strong earnings studies (based on estimates)

Or scalp submit-earnings gaps using technicals

eight. Recession Fears? Trade Risk-free-Haven Property

Thought: When economic downturn fears rise (observe bond yields, personal debt information), traders hurry to gold, Swiss Franc (CHF), and Japanese Yen (JPY).

System:

Get XAU/USD or USD/CHF dips

Pair with unfavorable financial information or worldwide slowdowns

9. Breakout Strategy Following Fed Conferences

Plan: Just after FOMC (Federal Reserve) fascination fee announcements, the marketplace breaks out in one way.

Pairs to look at:

USD/JPY

EUR/USD

Gold

Idea: Stay away from trading in the announcement. Look forward to the transfer, then trade the retest.

ten. Monday Hole Fills in Forex

Thought: On Monday mornings, many forex pairs open with a selling price hole. These gaps frequently get stuffed through the 1st buying and selling session.

Pairs: EUR/USD, GBP/USD, USD/JPY

Strategy:

Discover the gap

Enter on confirmation candle

Choose profit when rate closes the hole

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Joshua Jackson Then & Now!

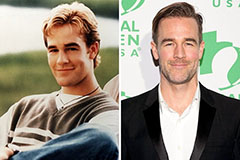

Joshua Jackson Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!